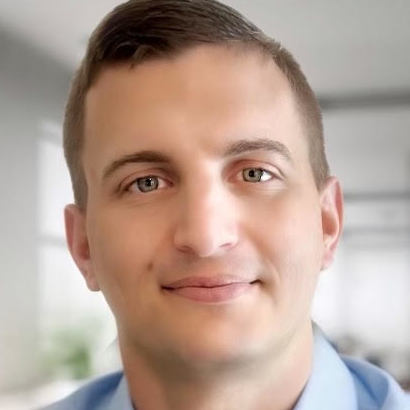

Ryan Ulk

Head of Wholesale Supply & Trading, Utilities

Ryan Ulk's Bio:

Ryan Ulk's Experience:

-

Head of Wholesale Supply & Trading at Chariot Energy & 174 Power Global

April 2024 - Present | Houston, TX -

Senior Director, Risk Management at MP2 Energy, A Shell Energy North America Subsidiary

March 2021 - Present | Houston, TexasLead the development and assist in the validation of key risk models and methods Oversight on forecasting, wholesale trade capture system, position management/exposure, financial pro-forma modeling, Mark-To-Market, and other key mid/back-office systems & models. Oversees the development, testing, and validation of quantitative models used for Mark-to-Market, and Risk Management Responsible for implementing and monitoring the risk policy Support the Wholesale teams to properly book standard and non-standard transactions Advanced analytical/quantitative skills to conduct forecast variance analysis (forecast vs actual) Assist with the build out of MP2’s shadow-settlement system Leads in evaluating and identifying model risks and reaches conclusions on strengths and limitations of all models used by the company Perform statistical analysis around historical and forward commodity price Quantitative analysis of risk and trading strategies that mitigate retail exposures and protect retail gross margin Maintain the data tables for energy and non-energy retail curves, utility load profiles, loss rates, and other related fundamental and technical data through coordination with Structuring and Trading Development and enhancement of Pricing Models and Load Forecasts. Worked with Settlements to gather key market & settlement data (e.g., historical data, rate schedules, profiles and loss factors) to build-out a shadow-settlement system.

-

Senior Director of Energy Supply & Marketing at National Gas & Electric

March 2015 - March 2021 | Houston, TexasResponsible for the development and management of the Supply Team for power and gas in U.S. deregulated energy markets and management of the staff. Optimize, hedge, and manage risks associated with the natural gas, power, and renewable s portfolio. Responsible for the execution of wholesale purchases and swaps to optimize gross margins. Actively monitored market pricing and positions of the retail book in order to optimize hedging opportunities to grow P&L while remaining competitive in the marketplace. Tracking and reporting of the company’s renewable energy requirements and management of the REC process. Ensured retail supply pricing for residential and commercial pricing matrices are created daily, monitoring market movement and validating the results. Built power and gas pricing models from scratch and developed procedures for on-going back-casting of load forecasting system, ISO invoices, and other attributes which serve as inputs in all models (Capacity, NITs, Losses, Ancillaries, etc). Power and Gas position reporting to supply counter-parties. Monthly fulfillment of company’s capacity obligations. Natural gas scheduling on a daily basis depending on the market structure, and execution on the monthly base load requirements. Also, created a model to value our Storage inventory in order to value our storage assets once we withdraw in the winter. On-going analysis and reporting to management of Supply COGs estimates. Technical analysis on the cost and market risk of different wholesale supply options. Established metrics and prepared monthly reports for the executive management team. Led cross-functional teams to address business process improvements initiatives; development, testing, and maintenance of the company’s load data. Responsible for the evaluation and development of new markets in relation to energy supply and risk. Responsible for getting National setup on all gas pipelines and power utilities prior to customers flowing. Led the M&A Analysis for Spark Energy and National Gas & Electric Managed online shopping sites in PA, OH, IL, MA, NY, CT Led the direct mail campaigns incorporating Eligible Customer List analysis, vendor management, postcard artwork development, and call center sales development Ongoing online brand management on differently platforms Led the financial planning and analysis for the company

-

Manager, Pricing - Electricity and Natural Gas at Just Energy

June 2014 - March 2015 | Houston, TX• Led a team of five direct reports for retail pricing for domestic and SME electricity and gas customers across North America. The team is responsible for owning, developing and updating pricing models, analyzing the key risks to gross margin, understanding competitor positioning and creating value added strategies to help Sales achieve company targets. • Developed a successful and efficient pricing framework to support the constant and ever-changing pricing requests made by the business, while developing a visible model that underpins tariff analysis to ensure margins are commercially driven to support revenue optimization goals. • Managed the development of robust commercial pricing models, clearly presenting inputs and outputs from the models to senior managers and other stakeholders to drive decision making. • Translated complex Utility pricing structures into system developments and easily understood reports and competitor information. • Monitored the delivery and creation of margin analysis for all retail tariffs • Developed products for Electric and Gas customers which create a value proposition for the customer and create a long term value proposition for the company from a financial perspective. • Support product and services expansion in the new and existing markets and modify products in response to demand and profitability. • Perform competitor analysis including product benchmarking, competitor strengths and weaknesses, general operating strategies, and rate competitiveness

-

Senior Energy Pricing & Structuring Analyst at NRG Energy (Formerly XOOM Energy)

May 2012 - May 2014 | Charlotte, NCResponsible for providing customized price quotes for electric and natural gas Commercial and Industrial customers in the 15 states and 70 markets which XOOM Energy is currently serving in. Also, responsible for developing mass market pricing for each of the 70 markets as well Work closely with Energy Supply and Load Forecasting to maintain pricing models that incorporate load shapes, wholesale and retail market costs, forward pricing curves, and other related fundamental and technical data for each utility Monitor current market conditions to seek opportunities to maximize margins and minimize risk Utilize wholesale market data to understand wholesale gas and power costs including energy, transportation, storage, congestion, losses, capacity, and transmission to insure efficient retail pricing and risk control Research appropriate tariffs to understand market rules, procedures, and pricing risks related to products. Coordinate with Operations, Sales, and Energy Accounting on pricing, billing, position reporting, contracts, and new product development. Research, improve, and assist in implementing new technologies and systems for pricing and structuring. Develop electric and natural gas pricing models for each market incorporating and staying current with the pricing components

-

Retail Power Pricing Analyst at PPL Corporation

August 2010 - May 2012Evaluated larger potential retail clients within the states of PA, NJ, MD, and DE. Helped determine what structured electricity products to offer those clients that would best fit their needs as well as evaluating what price at which to sell those products. Decisions were based on market conditions and an evaluation of risk and profitability. Exposed to the ever changing energy markets, commodity markets, retail competitive markets, risk analysis, portfolio management, sales and marketing strategy, and product structuring. As an analyst, we most commonly interface with our traders to follow the market, with our marketing team to ensure that we are properly setting up customer opportunities and with Salesforce to push our products. We also work with our contracts team, and our credit department, to lesser degrees and occasional work alongside any number of one hundred plus PPL EnergyPlus team members among the various teams that work on the trading floor.

-

Accounting/Economics Intern at East Penn Manufacturing

May 2010 - August 2010Reported directly to the VP of Finance and I performed various tasks in the Cost Accounting department regarding employee payroll and inventory for each of the 90 East Penn warehouses worldwide. Analyzed data and created reports pertaining to business travel expenses, wages, monthly sales, and monthly profits in the Finance department.

-

Internal Audit Intern at The Guardian Life Insurance Company of America

January 2010 - May 2010Worked in the Internal Audit Department and assisted the internal auditors in numerous projects relating to their insurance policies, mostly dealt with life insurance Assisted in insuring the accuracy of the company's internal records and analyzed the company's financial records for any possible mishandling or fraud

Ryan Ulk's Education:

-

University of Alabama, Manderson Graduate School of Business

2012 – 2014Master of Business Administration (MBA) -

Moravian College

2007 – 2011Bachelor of ArtsConcentration: Accounting and EconomicsActivities: Moravian College Football, Sigma Phi Epsilon, Omicron Delta Epsilon, Amhrein Investment Fund -

Muhlenberg High School

2003 – 2007

Ryan Ulk's Interests & Activities:

Finance, investing, energy, sports, fitness

This BrandYourself profile is automatically optimized to show up high in Google

This BrandYourself profile is automatically optimized to show up high in Google